While Most Investors Struggle In 2025's Property Market...

DISTRESSED PROPERTY INVESTORS CREATE A LONG-TERM, STABLE SOURCE OF PASSIVE INCOME

Our expert team have 25+ years of experience hand-picking distressed property investments that create a stable source of income, month after month, carefully selected based on your budget, individual needs and investing goals.

To get started, simply tell us about what you’re looking for in just 30 seconds and discover a selection of distressed property investments suited to your needs.

"Game-changing approach! Hands off, secure and completely passive income!" - Samantha D. ⭐️⭐️⭐️⭐️⭐️

*we'll never share your info with anyone

Fully Managed

Investments

Allowing you to sit back, relax & enjoy stable returns from your investment

Passive Income

& Hands-Off

With our model, you don't need to worry about managing the investment yourself

Invest With Just

55k In Cash

Our expert team hand-pick high potential Distressed property investments

High Yields

Over 14%

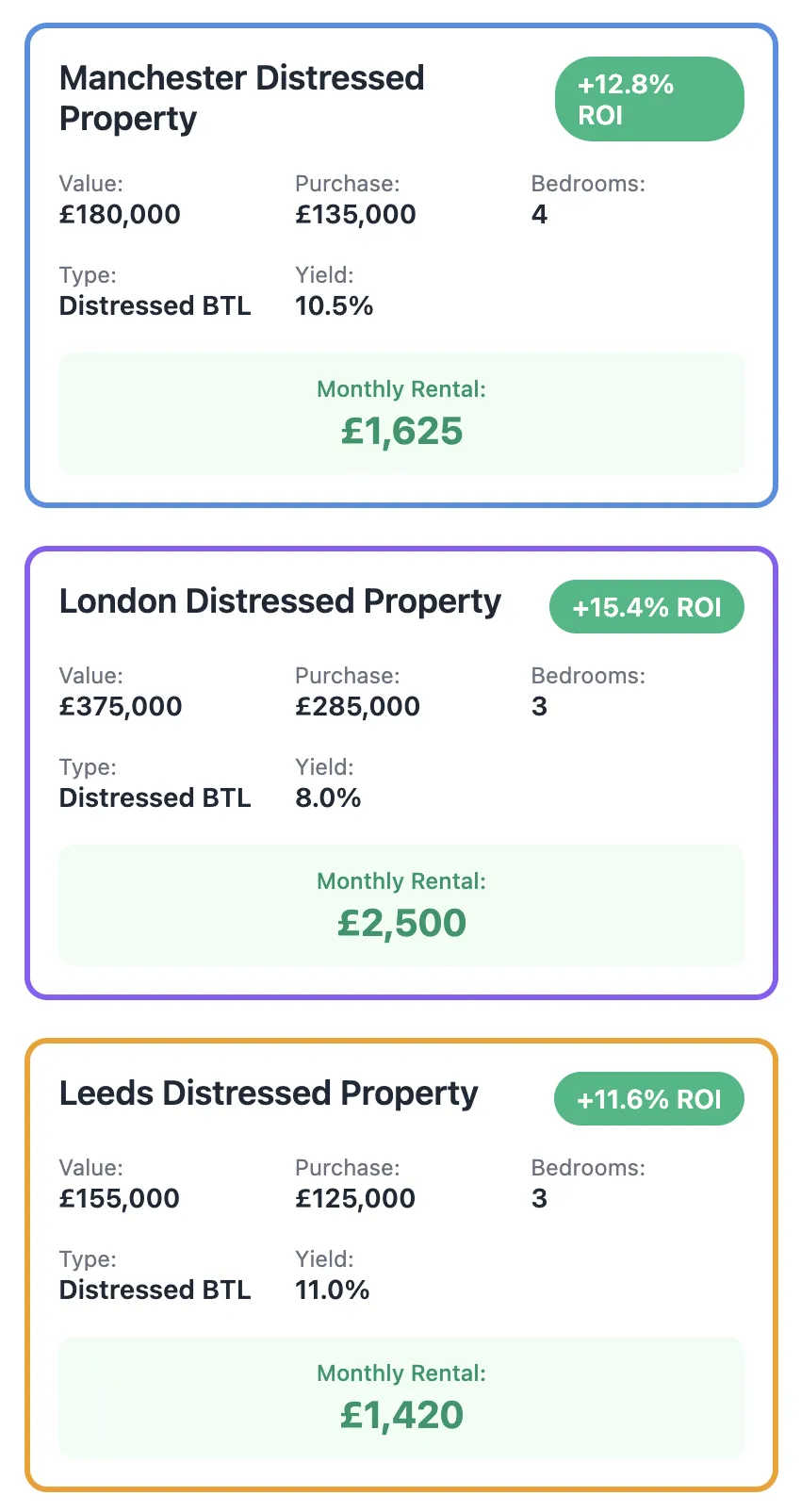

We offer a selection of distressed property investments from across the UK

£100 Million

Managed

We are established in the property investing industry with a 25 year track record.

"Partnering with DPG has been a game-changer. Their approach to undervalued assets and passive income is straightforward and transparent. I’m now building wealth while still having full control and security over my investments. It’s exciting to see such consistent returns on a month-to-month."

Sophie Williams, Marketing Executive, Birmingham

"I’ve worked with Distressed Property Group for over a year now. Their passive income model has given me both security and financial freedom, while still allowing me to focus on my career. I've also enjoyed the peace of mind that comes with knowing my assets are performing reliably."

Dr. Rajesh Kapoor, Consultant Surgeon, Manchester

"Working with DPG has changed my approach to property investment. The team helped me identify undervalued assets across the country and pursue opportunities that generate a steady income. I feel secure knowing I’m building passive wealth without the stress of day-to-day management."

Dr. Emily Harding,

GP, London

Here’s How It Works

Discover Hand-Picked Distressed Properties

STEP 1

Complete The Simple Investor Quiz Below

Answer a few simple questions, so we can present you with opportunities tailored to your needs.

STEP 2

Personal Expert Assigned

One of our team will hand-pick the best distressed-properties opportunities that are suited to your individual needs.

STEP 3

Receive Your Custom Plan

Speak to one of our experts and receive a breakdown of Distressed Property Investment opportunities

Complete the 1-minute questionnaire below to receive distressed properties investment opportunities tailored to your needs from your personal property expert.

25 Year Track Record & Proven Investor Results

Mr. Beck - £55k investment, £1.6k/month return - Distressed Property, Leeds

Mr Beck heard about us from a friend and invested in assisted living, providing safe housing for 10 residents, all while receiving steady returns.

Residential Property Converted For Assisted Living - Birmmingham

A three-bedroom bungalow was purchased below market value, converted into an assisted living residence, and secured a 15-year rental contract.

Derelict House Transformed into High-Yield HMO - Manchester

A three-bedroom bungalow was purchased below market value, converted into an assisted living residence, and secured a 15-year rental contract.

7 Reasons Why Investors choose us

Proven Track Record – Over 25+ years in the property investing sector

Access to Off-Market Deals – Opportunities you won’t find anywhere else online

Personalised Guidance – Every investor gets personalised guidance from our team

Government Backed Investments – Long term rentals mean consistent returns

Fully Managed Options – From sourcing to management, we handle it all

Low Barrier to Entry – Invest in distressed property with as little as £55k in cash

Trust & Transparency – We only recommend deals we’d invest in ourselves

Start Your Distressed Property Investing Journey Today

Starting your property investing journey can feel overwhelming. That’s why our team is here to guide you through the entire process.

With over 25 years of experience delivering stable returns on UK distressed property investments for both first-time and established investors, we provide support that is tailored to your goals.

Click below to get started 👇

Here's What Investors Often Ask Us...

Who can invest?

Anyone over the age of 18 can invest, whether you're a seasoned investor or completely new to property investing. No prior experience is required.

Typically, you will need at least £55,000 in cash to get started with our model, though we cater to a range of budgets. If you're unsure if you qualify, submit your details below and one of our property experts will be in touch to learn about your budget, investing goals and individual needs.

How do you ensure the deals are safe and profitable?

Every opportunity undergoes thorough due diligence covering:

· True market value

· Rental yield analysis

· Area demand and growth potential

· Legal and compliance checks

We only present deals that meet our strict investment standards.

Also, our investments are backed by secured rental income from government-backed lease agreements. While all investments carry risk, our model is designed to provide stability and predictable returns versus traditional buy-to-lets.

What makes this different from traditional property investing?

Traditional property investment requires high capital, ongoing management, and market risk. Our model is completely hands-off - we source, refurbish, and manage the property for you while you earn fixed monthly returns.

We have the existing networks to acquire properties well below market value, which you just don't get with traditional buy-to-let investing.

What type of investment options do you offer?

We have 3 primary distressed property investment types: buy-to-let, social housing and HMOs. Each of these options has different entry price points, buy to let from £40,000 with 10-12% expected returns annually, social housing from £75,000 with 12-15% annual returns and HMOS from £150,000 with 15-20% expected annual returns.

If you submit your details below, our expert team will run through each of the options and share what we believe is best suited to you.

What happens when I click 'Discover Distressed Investment Properties'?

Once you click the button below, you will need to answer a few questions about your investing goals, as well as provide your details (don't worry, we won't share these with anyone else).

Our team will then be in touch to learn a bit more about what you're looking for and share Distressed Property investment opportunities suited to your needs.

This call is 100% free and zero obligation. After the call, you can decide either way if it's right for you or not.

Want To Learn More About Distressed Property Investing?

Important Regulatory Information:

This offer is only available if you meet one of the following 2 criteria.

High Net Worth: I had an annual income of £100,000 or more, or I held net assets of £250,000 or more (excluding my primary residence, pensions, or life insurance policies).Annual income of at least £100,000 in last financial year OR net assets of £250,000 or more (net assets do not include primary residence or pension)

Self-Certified Sophisticated Investor: I certify that I am a Sophisticated Investor because at least one of the following applies: I am a member of a business angel network or syndicate for at least 6 months; I have made more than one investment in an unlisted company in the past 2 years; I have worked in private equity or providing finance to SMEs within the past 2 years;

Risk Acknoweldgement: Investments carry risk, including the risk of losing all the money I invest. Returns are not guaranteed and may be lower than expected. These investments are not covered by the Financial Services Compensation Scheme (FSCS). I will not have recourse to the Financial Ombudsman Service.

Only investors that meet these definitions and accept the risk will be eligible for entering into an investment outlined within.